Oil Recycling Fee Program

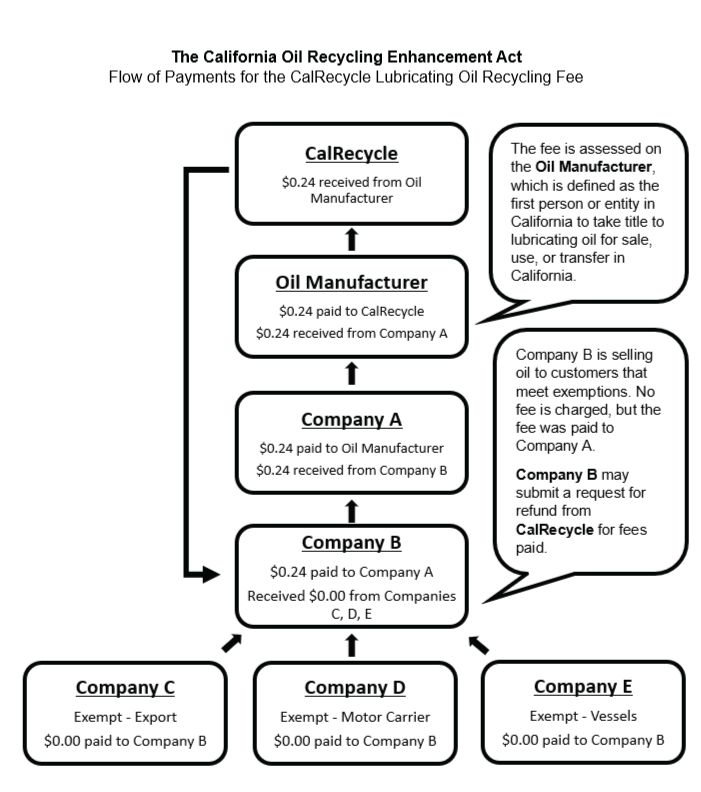

The California Oil Recycling Enhancement Act aims to discourage the illegal disposal of used oil. It requires Oil Manufacturers to pay CalRecycle a fee for all lubricating oil sold in California.

The Current Fee Rate

Lubricating Oil $0.06 per quart or $0.24 per gallon

Refined Lubricating Oil $0.03 per quart of $0.12 per gallon

Each quarter Oil Manufacturer must:

- Report how much lubricating and industrial oil over 5 gallons they sell quarterly

- Pay a fee on all lubricating oil sold

There is no fee on industrial oil.

Completed Oil Fee Return (CalRecycle 30A form) and Payments

Oil manufacturers must submit payments on or before the last day of the month following each quarter.

For example: the Oil Fee Return and payment for January – March is due on the last day of April.

- The Oil Fee Returns and payments must be received or postmarked before the due date.

- If the due date falls on a weekend or holiday, the due date becomes the following business day.

- Payments received or postmarked on or after the due date are late and will owe a 10% penalty as well as monthly interest.

Credit Card Payments for the Lubricating Oil Fee

Resale of Oil – Fee Paid

If your company:

- Files and pays a Quarterly Oil Fee Return to CalRecycle and

- Sells 100 gallons or more of oil to another company and charge the Oil Fee to that company as reimbursement

You must provide the purchaser company written notice of the year and quarter that the initial fee was paid to CalRecycle.

Exemptions:

- Oil whose payment was already made to CalRecycle.

- Oil with a volume of five gallons or less.

- Oil exported or sold for export from the state.

- Oil sold for use in vessels operated in interstate or foreign commerce.

- Oil brought into the state in the engine crankcase, transmission, gearbox, or differential of an automobile, bus, truck, vessel, plane, train, or heavy equipment or machinery.

-

Bulk oil:

- Imported into, transferred in, or sold in the state to a vehicle’s owner, as defined in Section 408 of the Vehicle Code, and

- Used in a vehicle such as:

- Heavy duty truck

- Buses

- Large trailers and

- All others designated in three subdivisions (a) and (b) of Section 34500 of the Vehicle Code

If oil previously exempted from payment is later sold or transferred, whomever sells, transfers, or uses the oil for non-exempt purposes must make the payment.

Oil Manufacturers must maintain records for at least four years.

Lubricating Oil Seller Requirements

- For lubricating oil sold by weight, a weight to volume conversion factor of 7.5 pounds per gallon shall be used to determine the fee.

- Any sales transaction of over 10 gallons of lubricating oil with a fee due must identify the fee amount separately from the cost of the oil.

Definitions

#

Industrial Oil

Includes, but is not limited to, any compressor, turbine, or bearing oil, hydraulic oil, metal-working oil, or refrigeration oil. Industrial oil does not include dielectric fluids.

Lubricating Oil

Includes, but is not limited to, any oil intended for use in an internal combustion engine crankcase, transmission, gearbox, of differential in an automobile, bus, truck, vessel, plane, train, heavy equipment, or other machinery powered by an internal combustion engine. Lubricating oil also includes consumer additives which are intended to be mixed with lubricating oils in an internal combustion engine and synthetic lubricating oils. Lubricating oil does not include oil intended for use in a 2-cycle engine where the oil is entirely consumed during usage.

Oil Manufacturer

Means the first person or entity in the state to take title to lubricating or industrial oil for sale, use, or transfer in the state of California. A person or entity who first takes title to lubricating or industrial oil from an out-of-state entity, for purposes of sale or distribution, is the oil manufacturer.

Refined Oil

Means a lubricant base stock or oil base derived from used oil and meets all the following criteria:

- Processed using a series of mechanical or chemical methods, or both, including at a minimum, but not limited to, vacuum distillation, followed by solvent refining or hydrotreating.

- Capable of meeting the Physical and Compositional Properties, in addition to the Contaminants and Toxicological Properties, as defined under the American Society for Testing and Materials (ASTM) D6074-99 standard.

- Processed into a material that has a performance quality level suitable for use in a finished lubricant. A producer of a rerefined base stock shall provide a purchaser of that base stock with information that certifies that the rerefined base stock is rerefined oil, as that term is defined above. Any rerefined base stock that does not comply with the above shall not be sold as rerefined oil and is subject to all applicable hazard, personal protection, and risk communication requirements until subsequent testing demonstrates compliance with the above.

CDFA Motor Oil Fee Program

- The Motor Oil Fee Program (MOF) is a fee imposed on the first production, sale, or distribution of motor oil in California, whether or not packaged in retail containers.

- It is only to be paid once on any particular motor oil and does not apply to motor oil exported for sale outside of California.

- The Motor Oil Fee Program is administered by California Department of Food and Agriculture (CDFA). This fee of $0.05 per gallon is administered separately from the CalRecycle program.

To register for this program, or if you would like further information, contact the Division of Measurement Standards at dms@cdfa.ca.gov or (916) 229-3000, or refer to their website, CDFA – DMS – Motor Oil Fee Program (ca.gov)

Statutes and Regulations

Statutes: Codes: Code Search (ca.gov)

Regulations: Browse – California Code of Regulations (westlaw.com)

Contacts

For assistance with the Oil Fee Returns:

OilFeeReturn@CalRecycle.ca.gov

For assistance with Requesting a Refund of the Oil Fee: